Thai auto industry faces short term challenges but long-term outlook remains bright

The automotive industry is key to Thailand's plans to become a global industrial powerhouse. The industry faces a number of challenges, including sluggish domestic demand, increasing competitive pressures, rising production costs and the impact of tariffs on exports and the global market. However, there are grounds for optimism about the log-term future, according to Adrian Ashurst, CEO of Worldbox Intelligence.

Edward Sornio

09/08/2025

Known as the "Detroit of the East," Thailand has long been a leading automotive manufacturer, producing a wide range of vehicles, including passenger cars, commercial vehicles, and motorcycles. Thailand ranks as the 10th largest producer of motor vehicles globally, growing by around 3.3% annually over the past decade. The production of one-ton pickup trucks and passenger cars has been the main driver of growth with Toyota, Honda, Mitsubishi, and Isuzu among the main players.

The sector accounts for around 10 to 11% GDP and provides direct employment to around 850,000 people, with an additional 1.5 million indirect jobs supported by the industry. The sector’s contributions extend beyond employment, driving demand for related industries such as steel, rubber, plastics, and electronics, which are integral to automotive manufacturing. 1

Transition to Electric Vehicles

More recently, the government has encouraged the development of electrical vehicle (EV) production, aiming to produce around 750,000 units a year by 2030. The country has successfully attracted huge investment by Chinese EV makers, which now account for around 70% of production. 2 Government incentives promoting EV use and the ASEAN-China Free Trade Agreement, which allows EV imports from China without tariffs, has encouraged Chinese car makers into the country

Thailand is also already Southeast Asia's second-largest EV market with registrations hitting 76,000 units in 2023, up from less than 10,000 units in 2022. However, registrations decline to around 70,100 units, an 8% drop, in 2024. Challenges include weak after-sales service, with long repair times and a lack of parts availability that is harming consumer confidence.

There are also concerns that the market is becoming saturated as Chinese EV makers, facing excess capacity at home target foreign markets like Thailand.

Reuters cites the example of Neta, among the earliest Chinese EV brands to enter Thailand in 2022, as "an example of a struggling automaker finding it difficult to meet the requirements of a demanding government incentive programme meant to boost Thai EV production". 3

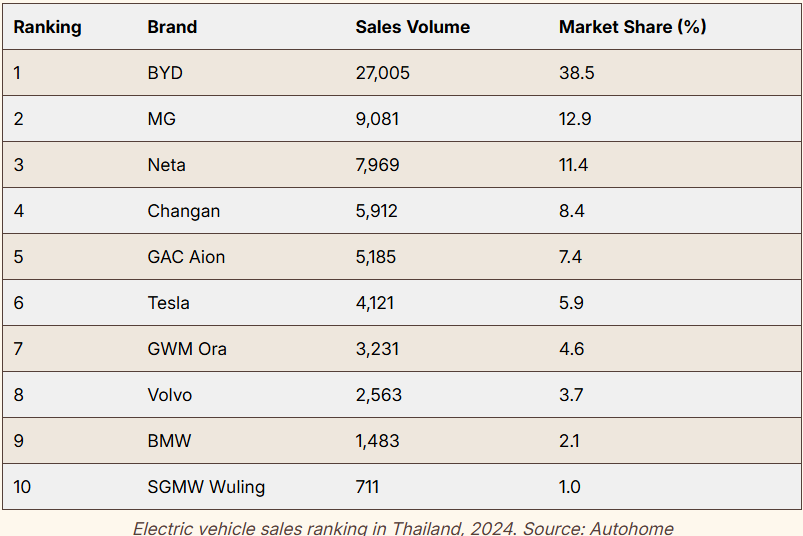

The Thai government has mandated ambitious local production targets in return for giving carmakers exemption from import duties. However, citing slowing sales and tightening credit conditions, carmakers asked the government to adjust the scheme and the 2024 production shortfall was rolled over into this year. Neta is still struggling to meet the production targets and is facing complaints of poor service. Indeed, Thailand's consumer watchdog is investigating Neta Auto after a surge in complaints. Many of the smaller Chinese brands like Neta are struggling to compete with the dominant player BYD. Carmakers are discounting models heavily to shift large stockpiles of cars. BYD aims to use Thailand as a bridgehead to penetrate the rest of the Southeast Asian market.

Figure1: Thailand EV market share by brand 2024

Source: https://carnewschina.com/2025/01/23/

byd-crowned-thailands-2024-ev-sales-and-surpassedc-toyota-in-singapore/

Lessons from the past

China's EV market has undergone rapid consolidation. The number of domestic EV makers fell from 487 in 2018 to about 130 in 2024 and there are likely to be fewer than 15 brands left by 2030, according to US consulting firm AlixPartners. China's top economic planning agency warned BYD and other Chinese EV companies last month to not sell cars below cost. 4

In the long run, however, the failure of some smaller Chinese EV makers is unlikely to impact the growth of the market inn China or in Thailand. The US experienced a similar consolidation at the birth of its automobile industry. There were thousands of US automakers in the 1910s and early 1920s, a figure that had reduced to just three major players by the 1990s. Yet the industry has thrived and generated huge revenues, taxes and employment.

Signs of recovery in Thailand

There are positive signs of progress despite the sales slippage this year. In April 2025, for example, the country recorded its first exports of EVs with 67,085 vehicles manufactured for export, accounting for 64.35% of total production. 5 The country also continues to attract hefty FDI in 2025 into the EV maintenance and repair services sector, according to the Commerce Ministry. 6 And in February this year, Mazda announced a plan to strengthen Auto Alliance Thailand, its joint venture manufacturing base with Ford in Thailand, with an investment of $148m in a bid to become a regional manufacturing hub.

The government has also announced measures to try and encourage demand for new cars. In March, it offered loan guarantees for pickup trucks, a key sector of the auto industry in the country. 7 Soaring household debt and limited access to credit have hamstrung the sector, pushing car loan rejection rates to 70%.

Industry insiders also believe the auto sector has bottomed out and recovery is now underway. Reuters quoted Pongsak Lertrudeewattanavong, vice president of MG Motor's Thailand unit, speaking ahead of Bangkok International Motor Show in March as saying that, "the auto sector should gradually improve." 8

Overall, therefore the outlook for the auto sector remains positive. The domestic market is likely to remain challenged by high debt rate and sluggish economic growth. However, there appears to be strong public demand for EVs with consumers keen to move to greener and more economical vehicles. Thailand offers generous incentives which should help it reach its ambitious production targets. With around 30% of passenger vehicles to be of the zero emission variety by 2030. The number made in the country is expected to surpass one million before 2035, according to Asian Insiders.

Moreover, the country plans to have all cars registered to be zero emissions by 2035. Notably, says Asian Insiders, public perception of EVs in Thailand is increasingly positive as consumers are placing greater importance on the environment when purchasing a vehicle.

Sources

- 1 https://www.aseanbriefing.com/news/thailands-automotive-industry-a-guide-for-foreign-investors/

- 2 https://www.reuters.com/business/autos-transportation/chinas-intense-ev-rivalry-tests-thailands-local-production-goals-2025-07-05/

- 3 https://www.reuters.com/business/autos-transportation/chinas-intense-ev-rivalry-tests-thailands-local-production-goals-2025-07-05/

- 4 https://restofworld.org/2025/chinese-ev-thailand-neta-backlash/

- 5 https://www.nationthailand.com/business/automobile/40050341

- 6 https://www.nationthailand.com/blogs/business/economy/40051901

- 7 https://theinvestor.vn/thailand-seeks-to-revive-automotive-industry-d14975.html

- 8 https://www.reuters.com/business/autos-transportation/thailands-auto-industry-shows-signs-recovery-amid-slump-executives-say-2025-03-25/